1 Wall Street Analyst Thinks Spirit Airlines Stock Is Going to $4. Is It a Sell?

A Barclays analyst recently reinstated coverage of Spirit Airlines (NYSE: SAVE) and slapped a $4 price target on it with an "underweight" rating. To put that figure into perspective, it was more than 17% lower than the share price at the time of writing.

Spirit Airlines faces challenges

The analyst referred to the company's headwinds in 2024, and it's hard to disagree. Now that the merger with JetBlue is off the table, Spirit must deal with its issues alone. They are not insubstantial.

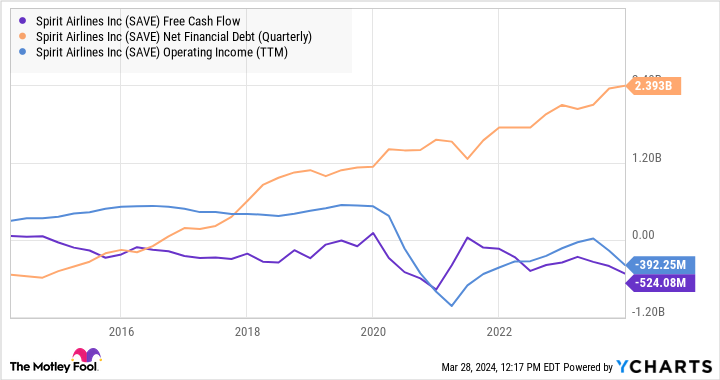

The airline is one of many that have racked up debt due to pandemic-related pressures that have severely damaged the travel sector and airline industry. Its history of cash outflows and weak profitability means investors aren't confident that Spirit will cut its debt burden in due course.

Engine issues don't help

A slowing economy and rising costs put pressure on budget airlines, and Spirit also has an issue with its all-Airbus fleet. The need to ground Airbus planes using some Pratt & Whitney geared turbofan (GTF) engines hit Spirit operationally and financially, leading it to an even more precarious debt profile.

Unfortunately, the airline industry's history is littered with bankruptcies and companies that failed to deliver returns to shareholders. At the same time, bondholders benefited from their investment being backed by the security of the planes themselves. If it all goes wrong, the aircraft can be sold, and debtholders usually take precedence over equity investors in a bankruptcy.

Spirit Airlines may well recover, but it's a high-risk/high-return investment that won't suit most investors. As such, it's hard to disagree with an underweight rating rating on the stock, which is effectively a "sell" recommendation, in my view.

Should you invest $1,000 in Spirit Airlines right now?

Before you buy stock in Spirit Airlines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Spirit Airlines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Barclays. The Motley Fool has a disclosure policy.

1 Wall Street Analyst Thinks Spirit Airlines Stock Is Going to $4. Is It a Sell? was originally published by The Motley Fool